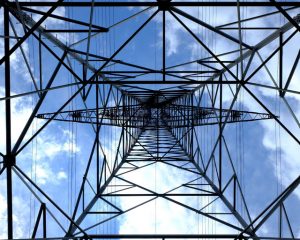

Investing in power systems demands a thorough understanding of the business and its risks.

Our Investment Advisory and Due Diligence approach employs technical due diligence as a vital risk management tool to identify potential limitations and opportunities for mergers or acquisitions.

Our team conducts detailed technical due diligence to develop practical strategies and mitigate any key risks in the vendor’s business case model.

Using our extensive global experience, we identify potential business opportunities that can lead to future performance upsides. With our wealth of industry experience, we conduct tailored and detailed technical due diligence on any power system asset worldwide.

Our comprehensive approach to power system investment involves: